How to set up a c-level ESG Corporate Governance Structure

Kamila Wosińska

Head of Group ESG Governance / Mentor&CoachCreating an Effective ESG Corporate Structure: A Personal Journey

Introduction

Hello everyone, my name is Camilla Bossa. With significant experience in business strategy planning and implementation, I am thrilled to talk about ESG sustainability and share my insights within this area. The goal of this discussion is to inspire and motivate you for change, not just present a predetermined structure. Through my story, you'll learn how to build an effective corporate ESG structure on the basis of real experiences, mistakes, lessons learned, small successes, and challenges.

Understanding the Concepts

Firstly, understanding key differences between three crucial terms -sustainability, corporate social responsibility (CSR), and ESG- is essential.

- Sustainability in business refers to running compromises between economic, social, and environmental factors while ensuring long-term operation and growth. Sustainability hopes for a resilient, equitable, and prosperous future for all stakeholders. However, interpretations may vary among different organizations.

- CSR is how a business voluntarily improves its impact on society and the environment beyond what's required by law. It includes philanthropic donations, community service programs, and environmental sustainability initiatives.

- ESG offers a practical viewpoint evaluated on three criteria: Environment, Social, and Governance. Activities vary from carbon footprint, resources used, social labor practices to community involvement, and corporate governance.

CSR is a precursor to ESG where the latter puts a quantifiable stamp of credibility on the former's philosophy. Broadly, sustainability is the umbrella under which both CSR and ESG fall.

Setting up an Effective ESG Corporate Structure

Understanding the rising global urgency for sustainability marked by the 2015 Paris Agreement, we were tasked with integrating this into our business practices. We set up a CSR steering committee, translating strategy into an agenda with goals, and various KPIs. Specific roles involved our financial officer focusing on climate protection and energy consumption, HR (society, employees, diversity, inclusion strategy, volunteering activities), Operations (data governance journey, systemized data collection), and a communication department (non-financial report governance).

Challenges En route to Execution

The journey was smooth until new market demands asked for an extension of CSR initiatives. As the amount and complexity of data grew, conflicts and resistance emerged, leading to a blame game on the unclear responsibilities. The challenge was to fit the ESG responsibilities within the existing corporate structure.

Acquiring a Sea-level Corporate Governance

At this juncture, there is a realization that a proper sea-level corporate sustainability structure is needed. It calls for a holistic ESG view from regulatory to data governance to compliance. Every company requires an accountable individual who can approach all ESG pillars holistically. It is advisable to refrain from burdening already preoccupied roles with additional ESG responsibilities.

Conclusion

In conclusion, for a successful ESG implementation:

- Focus on each ESG pillar from regulatory, strategy, data governance to compliance.

- Assign an accountable individual overseeing all ESG aspects.

- Integrate ESG as a central part of organizational culture.

This approach will ensure ESG principles are reflected in every company policy, procedure, and outcome, fostering business sustainability.

Video Transcription

So, hello everyone. Uh That's hard to see how many of you are there. Uh Before I start uh any slide show, uh let me just introduce myself. My name is Camilla Bossa.Uh And I'm going to talk about the uh CS resg sustainability topic, sharing some of my experiences and knowledge with you. I thought a lot, how should I present the topic to you? Um And the best practices around the ESG corporate structure and to fulfill uh the four of the key takeaways promise that I gave you in the speech abstract. So probably you're here because of that. Um And as I have quite sound professional experience in business strategy planning and execution. And through the years, I've somehow mastered creating and implementing uh new organizational structures. My first desire was just to show you how that should be done and I will show you the picture and the presentation. But then I realized that I would be like one of the external consultants, like from the big four, you probably already had the uh cooper operation with them in terms of the ESG. Uh So where job we hold the respect to their knowledge and experience.

It's, let's say quite of the nice piece of work to telling us how something should be done. But ultimately, then this is you, this is me uh who is just staying with all of that knowledge and the structures and need to figure out how to implement and execute it within their organization, our organization, like within the uh our uh business uh uh business oriented and uh and business specific reality.

So then I thought about hmm I'm here because of my like inner uh uh motivation uh because of my talents and then my most desire is to just inspire you and to motivate you uh through the change. Mm So this way, I decided that rather than just showing you the proper structure, I will tell you the story, I will tell you the true story of the corporate ESG structure creation based on my experience with all the lessons learned, with the mistakes, with the small successes and challenges.

So what I hope you will find yourself at some point in this story and then you will draw the best because your own conclusions and we'll choose what will work best for you. Um But before the story, I believe that most of us uh are already aware of the sustainability, corporate social responsibility and ESG concepts because we are on this, uh we are on these sessions. But let me please quickly summarize and stress the main differences between these three concepts.

Because that will help us to understand why today we talk about the importance of setting up the proper sea level corporate governance structure around it. So let me right now start um my slide sharing uh so that you see it. Uh So sustainability, CS R and ESG uh are all related concepts that share the same focus on the responsible business practices, but they have different meanings and applications. Uh Let's start with the sustainability in business context. Sustainability refers to the practice of concluding uh conducting business in a way that balances economic, social and environmental consideration while ensuring that the business can continue to operate and grow over the long term. And ultimately, the goal of the sustainability in business is to create more resilient uh equitable and prosperous future for all stakeholders, including shareholders, employees, customers and the broader community. I would say that sustainability is rather the vague concept in business context, creating more resilient and prosperous future may mean different things for different people, different organizations and even different entities within the one organization. So here we have the CS R and TSG concept.

There are two different approaches that businesses can demonstrate their commitment to sustainable business practices and to manage their impact on society and environment. TSR can be seen as holistic big picture uh perspective on sustainability. It refers to companies volunteering actions to improve its impact on society and environment pay on was required by law CS R initiatives may include philanthropic donations, community service programs and environmental sustainability efforts. While ESG is the practical and oriented perspective, it is the set of criteria used to evaluate companies performance in free areas, environment, social and governance. So activities such as carbon footprint or resources used in social labor practices, uh community engagement and in the governance part, we also need to focus on our board structure uh and the executive compensation, for example. So based on that, I would say that CS R can be rather seen as the precursor to ESG companies self regulate and commit to sustainable practices. With the aim of making a positive impact on society. Then the efforts uh undertaken in CS R strategy can be refined and fit into the ESG metrics ESG data can be then reported and shared via ESG reports.

We can say that ESG actually is like putting them quantifiable stamp of credibility on the board management philosophy of CS R. And finally, just to close that summary, sustainability is the umbrella that both CS R and ESG terms fall under and contribute to. Uh this is much broader concept that encompasses social, economic and environmental aspects of responsible business practices. Let me start sharing for the moment because I know that I promised you the story and but we're here not to talk about the concept of CS R sustainability and ESG but about the ESG corporate structure. Um I won't take you back to the 2015 to the Paris Agreement uh when 17 sustainable Development Goals were announced. Um but the truth is that, that all started then for the sake of simplicity, I need to assume that we are all aware of the 17 sus sustainability development goals or at least heard about it and we also heard about the non financial reporting requirement. My current company with a couple of 1000 employees listed company listed on the Stock Exchange and additionally headquartered in Germany, which is really regulated marketing within the European Union. We became a subject of the non-financial reporting requirement quite quickly in 2018.

However, there were no specific regulations and directions in place for businesses to follow. So companies like mine were completely unsure how to integrate the sustainability into their business practices. We realized that to truly make a difference, we need to take our commitment to sustainability.

So we began to organize ourselves around the CS R corporate, social responsibility and climate protection, understood like energy consumptions reductions or carbon footprint reductions. We knew it's extremely important topic and we really wanted to truly contribute. So we have quickly identified the key activities around the CS R and right now, I will come back to the Shain. So give me a second. So these are our three key activities that we has quite quickly identified. So first of all, we needed our CS R agenda and initiatives. We also needed to be compliant to the legal requirements. But then the only legal requirement actually was the non-financial reporting. So for the non-financial reporting disclosure, we mainly need to govern the information and the data needed to prepare the report. That's why we also knew that we needed the data governance and collection. We also identified the key roles that would be needed to follow these three steps.

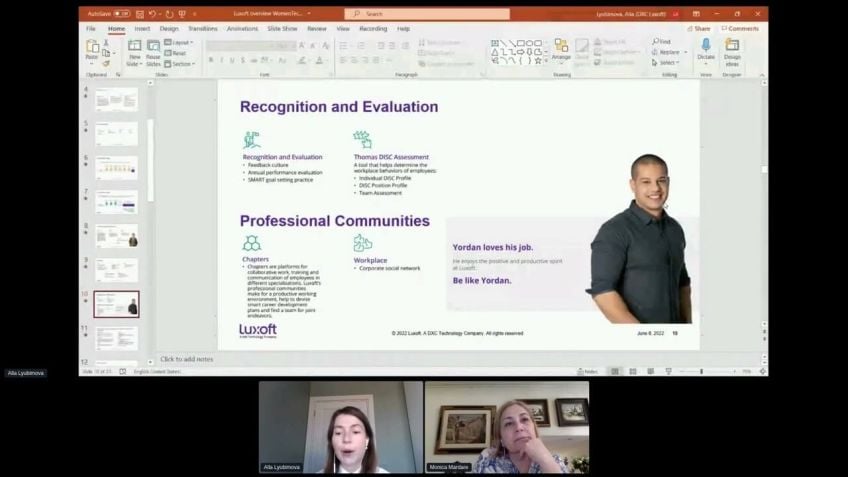

So we set up our CS R steering committee. Uh and we established a long term strategy. We also translated it into our agenda with goals and a KPIS for each entity to follow. Uh Here, you can see that our financial officer played really a great role uh in the climate protection part, mainly because all the data regarding the energy consumptions were available in the controlling department. Hr of course, like providing us with the information and initiatives regarding the society, employees diversity and inclusion strategy and any volunteering activities we also needed, of course, the operations one. So our chief operation officer who was responsible for the data governance, systemized data collection and processing processes implementation.

And as you can see, the main role uh was played by the communication department because that was the department who was responsible for preparing and then uh submitting the non-financial report governance part. We did not need to explicitly extract it uh within our, our graph of the steering committee because all the topics around the corporate governance like ethics, data protection, anti fraud policies meant all of that were perfectly covered. Remember, we are listed and Germany headquartered company.

So as I said, the main CS R regulatory requirements was to publish the non-financial report with the information including the results of our activities around the CS R. So we organized ourselves uh in the context of from data to text process based on two key roles, communication and data governance and, and it all worked perfectly. As long as we talked about, the CS R Communication Department was reaching out CS R data governs with data and information requests. CS R data. Government's job was to think about how to organize information and data gathering from 13 years are uh initiative owners. So as I said, diversity and inclusion strategy and outcome. What are the group wide social volunteering commitments, empowering women and employee structure and of course, financial data, energy consumption and with the reduction targets, we needed to involve only couple of related functions asking them for the very beginning via email or even on the calls for the information to be able to run our end to end process from data to text.

But next year, the United Nations and European Union Sustainable Finance Strategy put a great pressure on our clients and the investors. So to respond to the growing market demand, we have extended our CS R steering committee by new functions and we also added the new activities on our agenda. But the execution part according to the concept from data to text didn't change the same. People did the same job. The amount of quantitative and qualitative data requests sent from communication department to CS R. Data governance was growing. So data governance needed to hold off any data system or automation and focus purely on the understanding data requirements and collecting the data and evidence.

There were new requirements for processes, procedures and policies implementations, more and more departments needed to be involved with no context. So treated it as a purely additional task uh to be done on their side. And you can imagine and believe me that we really encountered the uh resistance and we were treated like a pure pain in the ass actually here. So at this stage, the shifting of responsibilities and the blame game began, the number of questions and open topics were growing, who should be the owner of the environmental policy, for example, should that be financial officer? Just because he's able to provide energy consumption data based on the accounting system who should implement eu taxonomy eligible and alignment check process. Should it be operational department? Just because this is the implementation of the operational process or maybe that should be finance department because it is fin finally like about turnover Capex and topex calculations or maybe business because it's also checking what is behind our products and services, who should understand the growing regulatory requirements regarding each of the ES and G Pr s and then translate it into the operational needs and who should finally execute it, believe me or not, but you will not find the answer if you will try to stick to the existing craw and existing corporate corporate structure.

Think about it. If your CS resg lead leading person is from pr hr employing branding communication, it is obvious that he or she will focus on the final communication to the market and being far away of the willingness to understand GHG protocol or EU taxonomy requirements. If you will find out that maybe the best place for that would be the investor relations, which sounds logical because these are investors putting the pressure on us. He or she will always focus on the external ratings on the improvements and he, she will just pinpoint the gaps and signaling the improvements needed within the organization. And then waiting until it's done, you can of course hire the external consultants uh which will let you for the CS resg which will let your CS resg lead uh to know the scope of changes uh that needs to be done. They will even advise you how that should be done. But at the end, with all that knowledge and guidance, you will gain from, from the consulting, you will stay with the task of figuring out who and what should be implemented and executed specific to your business. To be clear, I'm not telling that you shouldn't use the external consultancy, not at all. We also do it and I really need their support. I just want you to make to be aware, but you also need to think about it inside your organization.

And this is the point. But I think that you should finally understand that you need the proper sea level corporate uh sustainability structure and the following collaboration structure. What you need is structured and holistic ESG CS R view from regulatory through strategy to get data governance to text.

It's no longer just the pure collaboration between the communication and data provisioning department. It is much more, this is regulatory requirements, understanding policies and procedures, data governance, data collection, then on financial input and only finally, the non-financial data can be prepared.

But actually, frankly speaking, we are at the same point we are facing right now, uh the CS RD implementation and based on the years of my experience, I will strongly call for action for mindset switch in your organization. And I'm strongly advising you to make ESG an integrated and central part of your organizational culture and make it show up in every policy procedure and outcome. First of all, you will need to focus on each ESG pillar from regulatory, from data to text. Secondly, you will need to put one accountable person for all the G uh ESG pillars. If you will try to put accountability on one of the existing functions you lost. Financial officer is enough to do with finance operations. One he needs to focus on the processes, systems and procedures, investor relations. Believe me, CS RD is not the only.